Your Golden cross stocks meaning images are available. Golden cross stocks meaning are a topic that is being searched for and liked by netizens today. You can Find and Download the Golden cross stocks meaning files here. Download all free photos and vectors.

If you’re looking for golden cross stocks meaning images information linked to the golden cross stocks meaning interest, you have come to the right site. Our site always provides you with hints for seeking the maximum quality video and image content, please kindly hunt and locate more informative video articles and graphics that fit your interests.

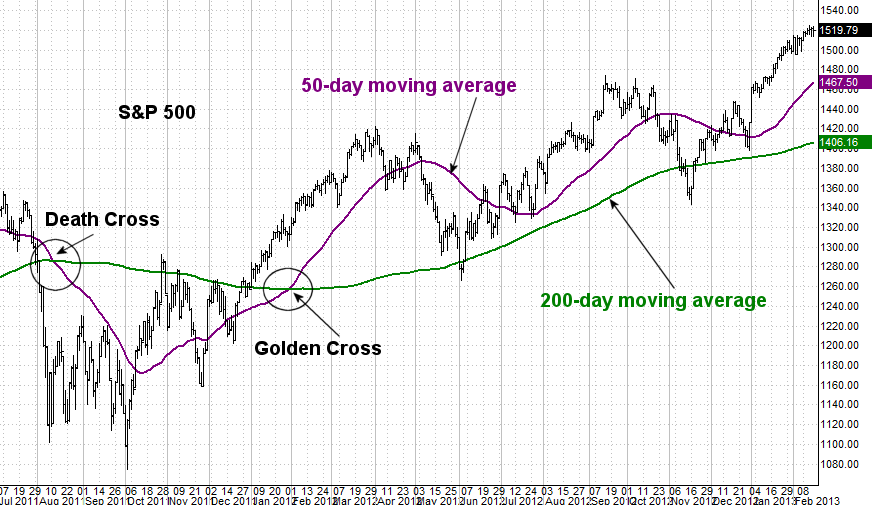

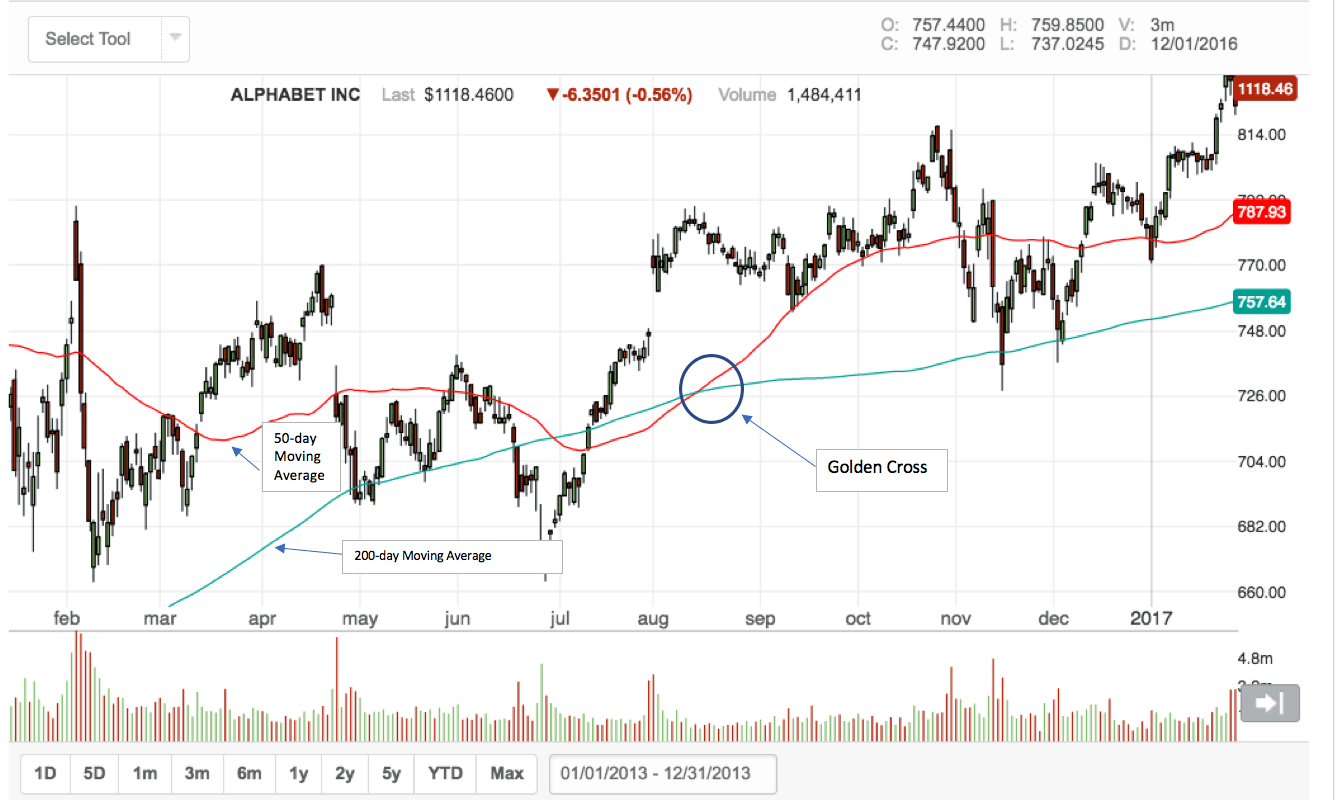

Golden Cross Stocks Meaning. The original golden cross trading strategy has its origins in the stock market. TVSSRICHAK TVS Srichakra Limited formed a GOLDEN cross at a price of 206965 using 20SMA and 50SMA. According to Joseph Granville a famous technician from the 1960s who set out 8 famous rules for trading the 200-day MA a golden cross can only occur when both the 50-day and 200-day moving averages are rising. What Golden Crosses Mean Usually calculated by comparing a 50-day to a 200-day moving average golden crosses are interpreted to mean that a stock is going up.

Golden Cross Trading 5 Best Golden Cross Strategies Trading In Depth From tradingindepth.com

Golden Cross Trading 5 Best Golden Cross Strategies Trading In Depth From tradingindepth.com

This is often considered a bullish indicator or a buy signal. This is seen as bullish. Typically the longer period moving average is set to 200-days and the shorter period to 50-days. This is typically a telltale sign of bullish sentiment for a stock reinforced by high. When the comparatively short-term moving average of a stock crosses over its long. Its the Golden Cross on the stock price chart.

When the comparatively short-term moving average of a stock crosses over its long.

The idea behind a golden cross is. Golden cross A golden cross in technical analysis signifies positive crossover between the 100 day moving average and the 50 day moving average. In the trading world a Golden Cross occurs when the 50 day moving average rises above its 200 day average. What Golden Crosses Mean Usually calculated by comparing a 50-day to a 200-day moving average golden crosses are interpreted to mean that a stock is going up. This is often considered a bullish indicator or a buy signal. The technical charts show the Golden Cross when a stocks.

Source: marketworld.com

Source: marketworld.com

The crosses on the 0 line indicate the crossovers of the EMAs. 84 stocks found which formed a GOLDEN cross in NSE using 20SMA and 50SMA 4 NSE stocks formed a GOLDEN cross with 20-50 Moving Averages on 09 Feb 2022. A golden cross is a basic technical indicator Technical Analysis - A Beginners Guide Technical analysis is a form of investment valuation that analyses past prices to predict future price action. Golden Cross The golden cross occurs when a short-term moving average crosses over a major long-term moving average to the upside and. It is a solid bullish price direction that works well with most crypto trading assets.

Source: bigtrends.com

Source: bigtrends.com

Golden crosses usually dont occur until an index or security has already begun its uptrend. Golden Cross and Death Cross are important Trend reversal points on a Technical chart of a Stock or Index. The opposite of the double cross signal is the golden cross signal. You can use the Golden Cross as a trend filter look to buy only when the 50-day is above the 200-day moving average. The technical interpretation of a golden cross is that the short term trend together with the long term trend has shifted.

Source: tradingindepth.com

Source: tradingindepth.com

The death cross stock trade occurs when the 50- day moving average crosses over the 200-day moving average. Typically a golden cross has more meaning. These crossings signify breaks above key levels of resistance. TVSSRICHAK TVS Srichakra Limited formed a GOLDEN cross at a price of 206965 using 20SMA and 50SMA. A golden cross is a basic technical indicator Technical Analysis - A Beginners Guide Technical analysis is a form of investment valuation that analyses past prices to predict future price action.

Source: netpicks.com

Source: netpicks.com

The idea behind a golden cross is. The original golden cross trading strategy has its origins in the stock market. Typically the longer period moving average is set to 200-days and the shorter period to 50-days. The technical interpretation of a golden cross is that the short term trend together with the long term trend has shifted. The opposite of the double cross signal is the golden cross signal.

Source: speedtrader.com

Source: speedtrader.com

The original golden cross trading strategy has its origins in the stock market. The Golden Cross is referred to as a candlestick stock trend that signals future bullish movements of a stock. Its last traded price is 206965 on 09 Feb 2022. You can use the Golden Cross as a trend filter look to buy only when the 50-day is above the 200-day moving average. This is often considered a bullish indicator or a buy signal.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

This is seen as bullish. Golden cross stocks are considered to have a bullish breakout signal. The death cross has all kinds of ramifications and its a strong bearish signal that has lead in the past to the stock market crash. The death cross stock trade occurs when the 50- day moving average crosses over the 200-day moving average. A Golden Cross is an indicator for bullish breakout patterns that are formed when an assets short-term moving average STMA such as the 50-day crosses over its long-term moving average LTMA such as the 200-day.

Source: ig.com

Source: ig.com

The crosses on the 0 line indicate the crossovers of the EMAs. On a stock chart the golden cross occurs when the 50-day MA rises sharply and crosses over the 200-day MA. A Golden Cross is when a short term moving average crosses above a rising long term moving average. This occurs when a short-term moving average such as the 50-day MA sharply rises and crosses over the longer-term moving average such as the 200-day MA. 101 rows Technical Screener for stocks whose SMA 50 recently crossed above.

Source: speedtrader.com

Source: speedtrader.com

A golden cross happens when a short-term moving average crosses over a long-term moving average MA toward the upside. 101 rows Technical Screener for stocks whose SMA 50 recently crossed above. The technical charts show the Golden Cross when a stocks. What Golden Crosses Mean Usually calculated by comparing a 50-day to a 200-day moving average golden crosses are interpreted to mean that a stock is going up. The idea behind a golden cross is.

Source: investopedia.com

Source: investopedia.com

When traders see a Golden Cross occur they view this chart pattern as indicative of a strong bull market. What are the three stages of a golden cross. A golden cross is a basic technical indicator Technical Analysis - A Beginners Guide Technical analysis is a form of investment valuation that analyses past prices to predict future price action. The idea behind a golden cross is. Golden Cross and Death Cross are important Trend reversal points on a Technical chart of a Stock or Index.

Source: investopedia.com

Source: investopedia.com

See also death cross. Golden cross A golden cross in technical analysis signifies positive crossover between the 100 day moving average and the 50 day moving average. What are the three stages of a golden cross. Golden crosses usually dont occur until an index or security has already begun its uptrend. The Golden Cross is referred to as a candlestick stock trend that signals future bullish movements of a stock.

Source: tradingsim.com

Source: tradingsim.com

The colors are formulated around the signal line default is 20 SMA. These crossings signify breaks above key levels of resistance. How do you know if investors are bullish on a stock. When traders see a Golden Cross occur they view this chart pattern as indicative of a strong bull market. When the comparatively short-term moving average of a stock crosses over its long.

Source: forextraders.com

Source: forextraders.com

This is typically a telltale sign of bullish sentiment for a stock reinforced by high. Learn to Trade Stocks Futures and ETFs Risk-Free That is with high trading volumes and higher trading prices the golden cross is possibly a sign that the stock market and individual stocks are poised for recovery. On a stock chart the golden cross occurs when the 50-day MA rises sharply and crosses over the 200-day MA. The Golden Cross is referred to as a candlestick stock trend that signals future bullish movements of a stock. It is a general rule that Stock gives a Buy signal when faster moving average crosses above the slower moving average while its gives a Sell signal when faster moving average crosses below the slower moving average.

Source: businessyield.com

Source: businessyield.com

A Golden Cross occurs when the 50-day crosses above the 200-day moving average and vice versa for a Death Cross Be careful of blindly trading the Golden Cross because the market can whipsaw you. The opposite of the double cross signal is the golden cross signal. Whats a Golden Cross. What are the three stages of a golden cross. It is a general rule that Stock gives a Buy signal when faster moving average crosses above the slower moving average while its gives a Sell signal when faster moving average crosses below the slower moving average.

Source: phemex.com

Source: phemex.com

TVSSRICHAK TVS Srichakra Limited formed a GOLDEN cross at a price of 206965 using 20SMA and 50SMA. These crossings signify breaks above key levels of resistance. Typically the longer period moving average is set to 200-days and the shorter period to 50-days. The technical charts show the Golden Cross when a stocks. What Is A Golden Cross.

Source: pinterest.com

Source: pinterest.com

This momentum oscillator uses the distance between the 1349 EMA Golden Cross metrics based on latest research to measure perceived momentum within a trend. The technical charts show the Golden Cross when a stocks. See also death cross. Golden Cross The golden cross occurs when a short-term moving average crosses over a major long-term moving average to the upside and. 84 stocks found which formed a GOLDEN cross in NSE using 20SMA and 50SMA 4 NSE stocks formed a GOLDEN cross with 20-50 Moving Averages on 09 Feb 2022.

Source: investopedia.com

Source: investopedia.com

This is seen as bullish. The original golden cross trading strategy has its origins in the stock market. The death cross stock trade occurs when the 50- day moving average crosses over the 200-day moving average. Typically the longer period moving average is set to 200-days and the shorter period to 50-days. A Golden Cross is when a short term moving average crosses above a rising long term moving average.

Source: speedtrader.com

Source: speedtrader.com

The technical charts show the Golden Cross when a stocks. What Golden Crosses Mean Usually calculated by comparing a 50-day to a 200-day moving average golden crosses are interpreted to mean that a stock is going up. The idea behind a golden cross is. Golden Cross The golden cross occurs when a short-term moving average crosses over a major long-term moving average to the upside and. A golden cross is a basic technical indicator Technical Analysis - A Beginners Guide Technical analysis is a form of investment valuation that analyses past prices to predict future price action.

Source: stockmonitor.com

Source: stockmonitor.com

Golden Cross The golden cross occurs when a short-term moving average crosses over a major long-term moving average to the upside and. Whats a Golden Cross. Golden Cross The golden cross occurs when a short-term moving average crosses over a major long-term moving average to the upside and. This is typically a telltale sign of bullish sentiment for a stock reinforced by high. This momentum oscillator uses the distance between the 1349 EMA Golden Cross metrics based on latest research to measure perceived momentum within a trend.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title golden cross stocks meaning by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.